Gift cards are a great way for a company to presell its products and to create cash flow. One of the problems with gift cards is that fraudsters are using the retailer’s weak internal controls to defraud the retailer’s customers. A fraudster can hack into autoloading gift cards and drain a customer’s bank account by buying new, physical gift cards through the autoloading gift card account.

Processes of an accounting system

The general ledger is helpful in that a company can easily extract account and balance information. We now return to our company example of Printing Plus, Lynn Sanders’ printing service company. We will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. Some of the listed transactions have been ones we have seen throughout this chapter. More detail for each of these transactions is provided, along with a few new transactions. The trial balance is the summation of all credits and debits within the business cycle.

- The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record.

- With the use of accounting software, the need to enter multiple journal entries has been reduced dramatically, but there are still instances when they are a necessity.

- At the end of the period, however, it calculates the balance of each ledger and prepares different financial statements like balance sheets, cash flows, etc.

- This may include computing the salary of the employees and estimating the depreciation value of a certain asset.

Cash Method vs. Accrual Method of Accounting

Identify which accounts are to be debited and which accounts are to be credited, ensuring that the total of all debits equals the total of all credits. Record the date, accounts affected, amount, and a short description of the transaction. In this example, the office supplies account is debited to reflect the increase in supplies, while the accounts payable account which transactions are recorded in the accounting system? is credited to record the liability incurred. When you’re looking at your accounting transactions, you can classify them based on relationship. Specifically, it takes into account whether or not money is being used out of the company, or within it.

- Identify which accounts are to be debited and which accounts are to be credited, ensuring that the total of all debits equals the total of all credits.

- Accounts receivable follows the same premise as accounts payable, only accounts receivable is used to record money that is owed to you by customers who are paying by credit.

- These rules are outlined by GAAP and IFRS, are required by public companies, and are mainly used by larger companies.

- The right accounting software will have all the needed accounting systems built in.

- You will have no trouble as long as you know how to use debits and credits and what accounts to record.

What Are the Different Types of Accounting?

- No matter which version a firm uses, it is a significant tool to track the performance of a business and accordingly help organizations plan different strategies for effective results.

- The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows.

- All types of business accounts are recorded as either a debit or a credit.

- Therefore, it can be said that any transaction that is entered into by two persons or two organizations with one buying and the other one selling is considered an external transaction.

- Both are labeled accordingly, which is dependent upon the individual transaction.

The fourth step in the process is to prepare an unadjusted trial balance. Identifying and analyzing transactions is the first step in the process. This takes information from original sources or activities and translates that information into usable financial data. An original source is a traceable record of information that contributes to the creation of a business transaction.

- The big benefit for business owners is they can access their financial info from anywhere—as long as they have internet.

- The first customer represents one transaction even though they purchased multiple items.

- But, modified cash basis uses double-entry accounting and includes more accounts than cash basis.

- Grocery stores of all sizes must purchase product and track inventory.

- The first, the accrual basis method of accounting, has been discussed above.

- The types of accounting transactions may be based on various points of view.

When you record a financial transaction in your books, use debits and credits to show the equal and opposite effects on two or more accounts. The accounting equation remains balanced because there is a $3,500 increase on the asset side, and a $3,500 increase on the liability and equity side. In the previous section, we gained a basic understanding of both the basic and expanded accounting equations, and looked at examples of assets, liabilities, and shareholders’ equity. Now, we can consider some of the transactions a business may encounter.

Calculating Account Balances

If you understand the definition and goals of an accounting system, you are ready to learn the following accounting concepts and definitions. For a more in-depth explanation of the accounting https://www.instagram.com/bookstime_inc system, take a look at the essential categories. If you are not yet familiar with the accounting elements and how each they work, see our lesson about Fundamental Accounting Concepts here. You have the following transactions the last few days of April. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

What Is an Example of Double Entry?

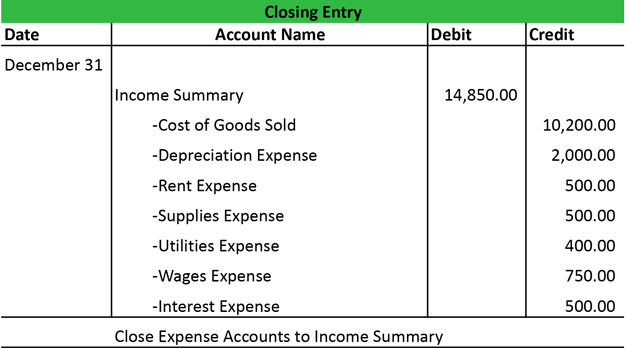

Internal transactions have to do with money being moved within a company itself. Internal transaction activity tends to come from a few sources. The two most common are paying wages, and the https://www.bookstime.com/ depreciation of assets.